Risk Management

In line with internationally recognized best practices, Petroperú has a Corporate Risk Management System, implemented based on the COSO ERM 2017 Framework standard"Business Risk Management: Integrating Strategy and Performance", in accordance with the approved Corporate Risk Management Policy.

Framework for Business Risk Management - COSO ERM 2017

The objective of the Corporate Risk Management System is to reduce the probability of occurrence and impact of the different risks that could affect the achievement of the company's organizational objectives (strategic objectives, process objectives and project objectives), to bring them to adequate levels to reasonably ensure the achievement of organizational objectives. Its scope includes the identification, evaluation, response and monitoring of risks.

Petroperú, committed to the implementation and maintenance of its Management System, develops risk maps and develops strategies to reasonably ensure compliance with organizational objectives and those related to the operations of the business units.

Risk management helps management protect assets, improves decision making, strengthens regulatory compliance, reduces losses, optimizes resources and improves reputation by generating value.

Risk management is an essential component for the sustainability and growth of companies, as it makes it possible to anticipate possible events that may compromise the achievement of business objectives. By identifying, assessing, and prioritizing risks, organizations can make informed decisions that minimize threats and identify opportunities to improve performance.

Stages of the risk management cycle

Enterprise risk management is essential to achieving business strategy and objectives. Well-designed enterprise risk management practices provide Petroperú management with reasonable assurance that they can achieve the overall strategy and business objectives.

Petroperú develops the stages of the Risk Management Cycle and carries out the identification, evaluation, response and monitoring of risks, considering the current context and emerging trends, prioritizing the treatment of the most critical risks.

- Identification

What uncertain events may affect the achievement of my goals? - Assessment

How likely are those uncertain events to occur and if they do occur, how much would they impact me? - Response

Response actions: accept, avoid, pursue, reduce, and transfer. - Monitoring

Periodic review of risks and monitoring of compliance with action plans.

Emerging risk

Petroperú continuously monitors external threats that have been classified in the categories applied by the World Economic Forum in its report"The Global Risk Report 2024" (Social, Technological, Economic, Geopolitical and Environmental) and are reviewed against aspects such as: Strategy and internal information of the company, current context of the sector at the national and global levels, among others.

In the context of risk management, an emerging risk has the following characteristics:

- New threats or changes to existing ones: These risks can arise from new technologies, regulatory changes, global events (such as pandemics or financial crises), or even the evolution of factors such as climate change or cybersecurity.

- Uncertain incidence: Although these risks can be perceived, their probability and future impact are difficult to predict accurately due to the lack of historical data or their complex nature.

- Complex to mitigate: Due to their uncertain nature, emerging risks are complex to mitigate. Greater flexibility and adaptability in risk management systems is required to anticipate and manage their impact.

In this regard, Petroperú has identified the main emerging risks, defined as those risks that could have a medium/long-term impact on the Company.

Critical business risks

The Corporate Risk Management System allows to identify, evaluate, prioritize and give a more effective treatment to the most critical risks faced by the various business units of the company. Critical risks are defined as those with a"High" level of criticality, the materialization of which could significantly compromise the strategic objectives and/or the most critical processes of the company.

These risks have the potential to:

- Compromise operational continuity.

- Causing substantial economic and financial losses.

- Deteriorate the reputation and trust of stakeholders.

- Impact on the safety and health of employees.

- Causing significant damage to the environment.

- Causing Regulatory Non-Compliance (applicable laws and regulations).

Effective management of these risks is essential to safeguard the company's assets, reputation and business continuity. Petroperú has identified 20 critical risks for its cash-generating units, considering their current context and the environment.

The 20 risks are grouped into operational risks related to refinery and production stability, financial and governance risks affecting organizational structure, credit ratings, and funding sources. They also include regulatory, environmental, and social risks that impact sustainability and compliance with regulations and commitments.

To this end, specific action plans are established that allow a proactive and effective response to the materialization of these risks. Prioritization of risk management efforts should be based on rigorous and ongoing analysis, ensuring that resources are optimally allocated to mitigate the most representative and potentially harmful risks.

Cash-generating units at Petroperú

Production and marketing

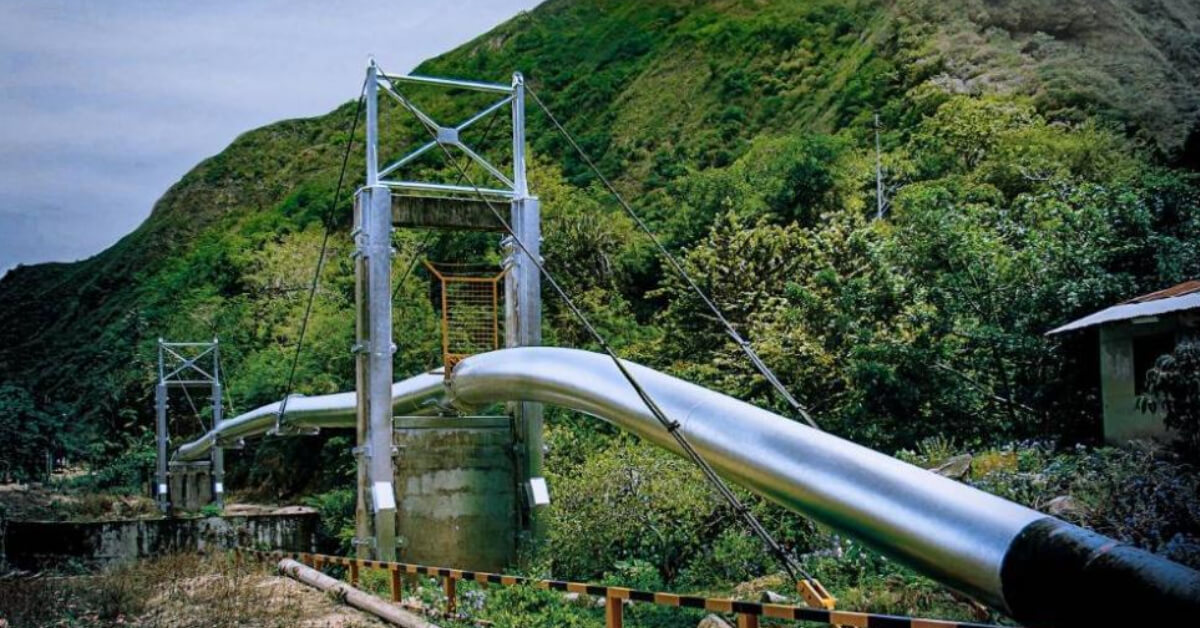

North Peruvian Pipeline Operations

Lot operation